AksharChem (India) Ltd – AKSHARCHEM Share Price Targets for 2024, 2025, 2030, 2035, 2040, 2045, 2050.

Why Portfolio managers and SIP managers add AksharChem (India) Ltd (NSE: AKSHARCHEM) Share for their Portfolio?

Why Should you need to buy AksharChem (India) Ltd – AKSHARCHEM Stock Script?

AksharChem stock price have strong momentum now a days.

Also, share price is above short, medium and long term everages.

This is turnaround company which come to profit from QoQ loss.

AksharChem (India) Ltd Company’s Core and Fundamental Values

With a focus on excellent product quality, services and maintaining relations with leading international chemical companies.

AksharChem are amongst the world’s most reputed and trusted dyes and pigments suppliers.

Most of AKSHARCHEM customers have been doing business with us for over 20 years.

Fundamental Analysis of AKSHARCHEM

| Market Cap | ₹ 281Cr. |

| Current Price | ₹ 350 |

| 52-wk High | ₹ 364 |

| 52-wk Low | ₹ 201 |

| Stock P/E | 0 |

| P/B Value | 1.06 |

| Face Value | 10 |

| Dividend | 0.14% |

| Book Value | 330.7 |

| Revenue | 4785.22 |

| EPS | -18.2 |

| Sales Growth | -12.10% |

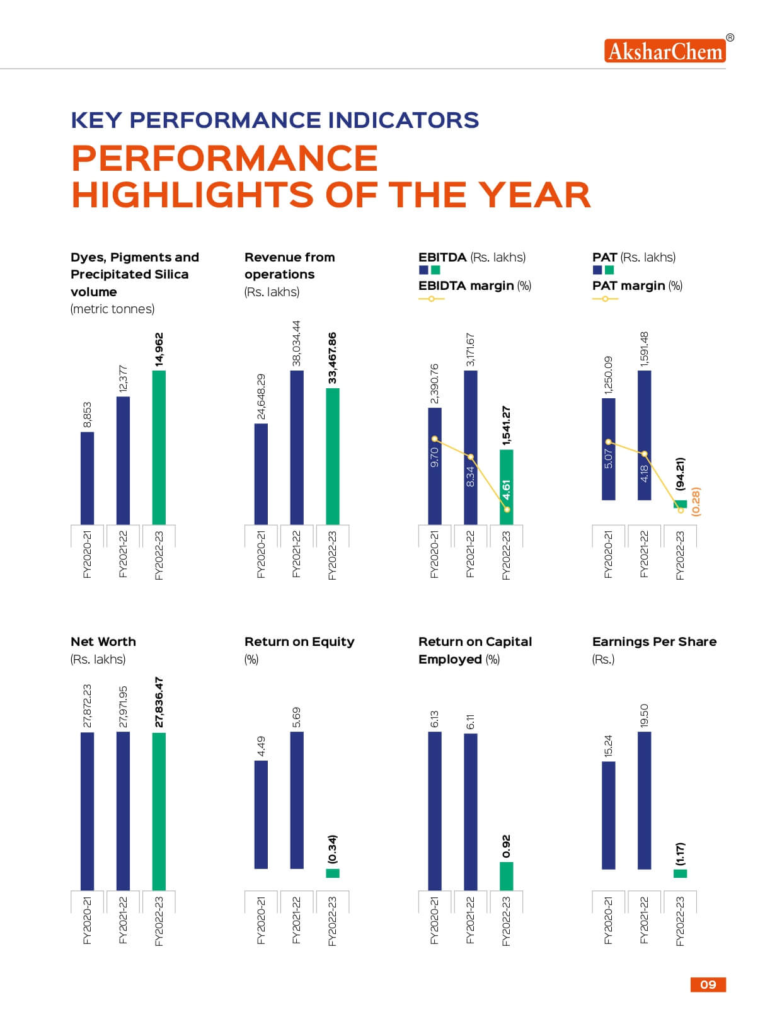

| ROE | -0.34% |

| ROCE | 0.86% |

| Debt | ₹ 24.63 Cr. |

| Debt to Equity | 0.09 |

| Profit Gwoth | -105.92% |

AksharChem (India) Ltd Shareholding Pattern

| Promoters Holding | |

| Dec 2023 | 62.70% |

| FII Holding | |

| Dec 2023 | 0.68% |

| DII Holding | |

| Dec 2023 | 0.06% |

| Public Holding | |

| Dec 2023 | 36.57% |

| Others Holding | |

| Dec 2023 | 0.00% |

AksharChem (India) Ltd – Last 5 Years Financial Conditions

Last 5 Years’ Sales:

| 2019 | ₹ 323 Cr |

| 2020 | ₹ 260 Cr |

| 2021 | ₹ 246 Cr |

| 2022 | ₹ 380 Cr |

| 2023 | ₹ 335 Cr |

| TTM | ₹ 285 Cr |

Last 5 Years’ Net Profit:

| 2019 | ₹ 23Cr |

| 2020 | ₹ 16 Cr |

| 2021 | ₹ 12 Cr |

| 2022 | ₹ 16 Cr |

| 2023 | ₹ -1 Cr |

| TTM | ₹ -15 Cr |

AKSHARCHEM Share Price Target 2024 to 2050

| 2024 | 514.20 |

| 2025 | 703.80 |

| 2026 | 893.25 |

| 2027 | 1098.10 |

| 2028 | 1361.95 |

| 2029 | 1651.60 |

| 2030 | 1830.55 |

| 2035 | 2141.25 |

| 2040 | 2279.80 |

| 2045 | 2517.25 |

| 2050 | 2789.05 |

Fib Level Price Target for Longterm Investments

| 1 | ALL TIME LOW | 135.05 |

| 2 | TARGET-01 | 324.25 |

| 3 | TARGET-02 | 385.30 |

| 4 | TARGET-03 | 424.75 |

| 5 | TARGET-04 | 514.20 |

| 6 | TARGET-05 | 603.70 |

| 7 | TARGET-06 | 635.55 |

| 8 | TARGET-07 | 703.80 |

| 9 | TARGET-08 | 734.10 |

| 10 | ALL TIME HIGH | 893.25 |

Gann Squre of 9 Price Level for Profit Booking

| 1 | LEVEL-01 | 133.20 |

| 2 | LEVEL-02 | 234.70 |

| 3 | LEVEL-03 | 336.15 |

| 4 | LEVEL-04 | 437.65 |

| 5 | LEVEL-05 | 539.10 |

| 6 | LEVEL-06 | 640.60 |

| 7 | LEVEL-07 | 742.05 |

| 8 | LEVEL-08 | 843.55 |

| 9 | LEVEL-09 | 945.00 |

Summary

AksharChem (India) Ltd has reduced debt.

Stock is trading at 1.00 times its book value.

This is the right time to invest for longterm in AksharChem share for longterm growth.

Note: Stopeloss is always your friend and put it wisly. Stoploss will protect you in any uncertain market moves. So, always consider stoploss as per your risk on capital and not stand again market.

Disclaimer: The information on this site is only for informational and educational purposes and shouldn’t be considered financial advice or stock recommendations. Also, the share price predictions are completely for reference purposes. Dear readers, we had like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The price predictions will only be valid when there are positive signs on the market. Any uncertainty about the company’s future or the current state of the market will not be considered in this study. We are not responsible for any financial loss you might incur through the information on this site. We are here to provide timely updates about the stock market and financial products to help you make better investment choices. Do your own research before any investment.

Leave a Reply

You must be logged in to post a comment.